Financial Markets Expectations

MAIN DATA AND INDICATORS TO ANALYZE

Defining the set of data and indicators to be analyzed is an essential task for building an investment portfolio suited to the objectives and preferences of each investor.

In the article on economics and financial markets, we analyze the correlation and causality and how both influence the return and risk expectations associated with the investment portfolio. Now, the conscientious and prudent investor must gather the set of expectations for the financial markets for the various asset classes of his investment portfolio.

ASSET CLASSES OF A PORTFOLIO

In wealth management, an asset class is a set of investments that have similar characteristics, behave similarly in the market, and have exposure to the same economic and financial factors.

These factors can be, for example, growth, inflation, employment, natural resources, buildings and land, infrastructure and even the behavioral and personal aspects of each investor.

Thus, in the construction of a portfolio, we can have as asset classes stocks, bonds and liquidity, which are the main ones, but also real estate, raw materials (commodities), private equity and venture capital, derivatives, such as futures and options, and even cryptocurrencies.

As financial advisors, in our approach, we also consider human capital as an asset class, as explained in the article Individual Wealth: a behavioral approach.

One of the main characteristics of an asset class is that it has a low (or even negative) correlation with the other asset classes in the portfolio. In this way, we were able to build a more diversified and more adjusted portfolio in terms of risk and return.

THE MAIN INDICATORS TO SELECT

After selecting the asset classes that will be part of the asset allocation strategy, we move on to the economic and market indicators that will make up the expectations report for the financial markets.

We can follow several guidelines, the main criterion being the investment policy of each investor, with their objectives and preferences determining the set of nominees to be analysed.

We have to specify the time horizon of our analysis and the results we intend to achieve, namely the expectations in terms of return, risk or other factors that we consider important in the financial plan.

There are several ways to group the different indicators. Next, we present a possibility that seems to fit the content of this article:

- Growth: trends and cycles

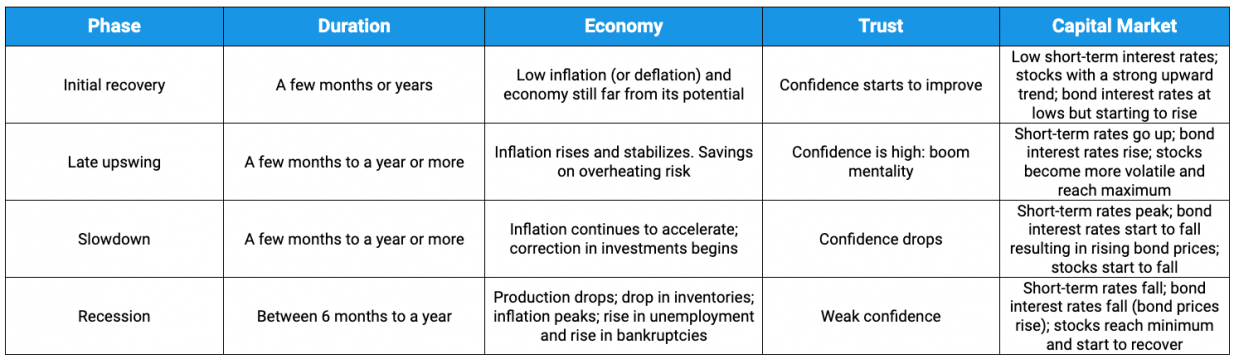

In this group of indicators we look at nominal and real GDP, GDP per capita, productivity and some cyclical and advanced indicators. The objective is to define the current and expected economic cycle. In a summarized and theoretical way, we can identify these trends in the following phases:

- Population, employment and unemployment: Here the most important indicators are the population of the region to be analysed, the level of employment, labor force and the unemployment rate.

- Fiscal indicators: at the fiscal level, it is important to analyze the government budget (deficit or surplus), public debt and national debt.

- Consumers and Balance of Payments: Disposable income, private consumption, savings rate and consumer confidence indicators.

Import and export of goods and services. External debt, current account balance, reserves. - IInvestment and savings: Investment designed for savings, inventories. Savings rate in the national economy.

- IIndustry and commerce: Conditions for business, economic environment. Industrial production and order level. Installed capacity and usage levels.

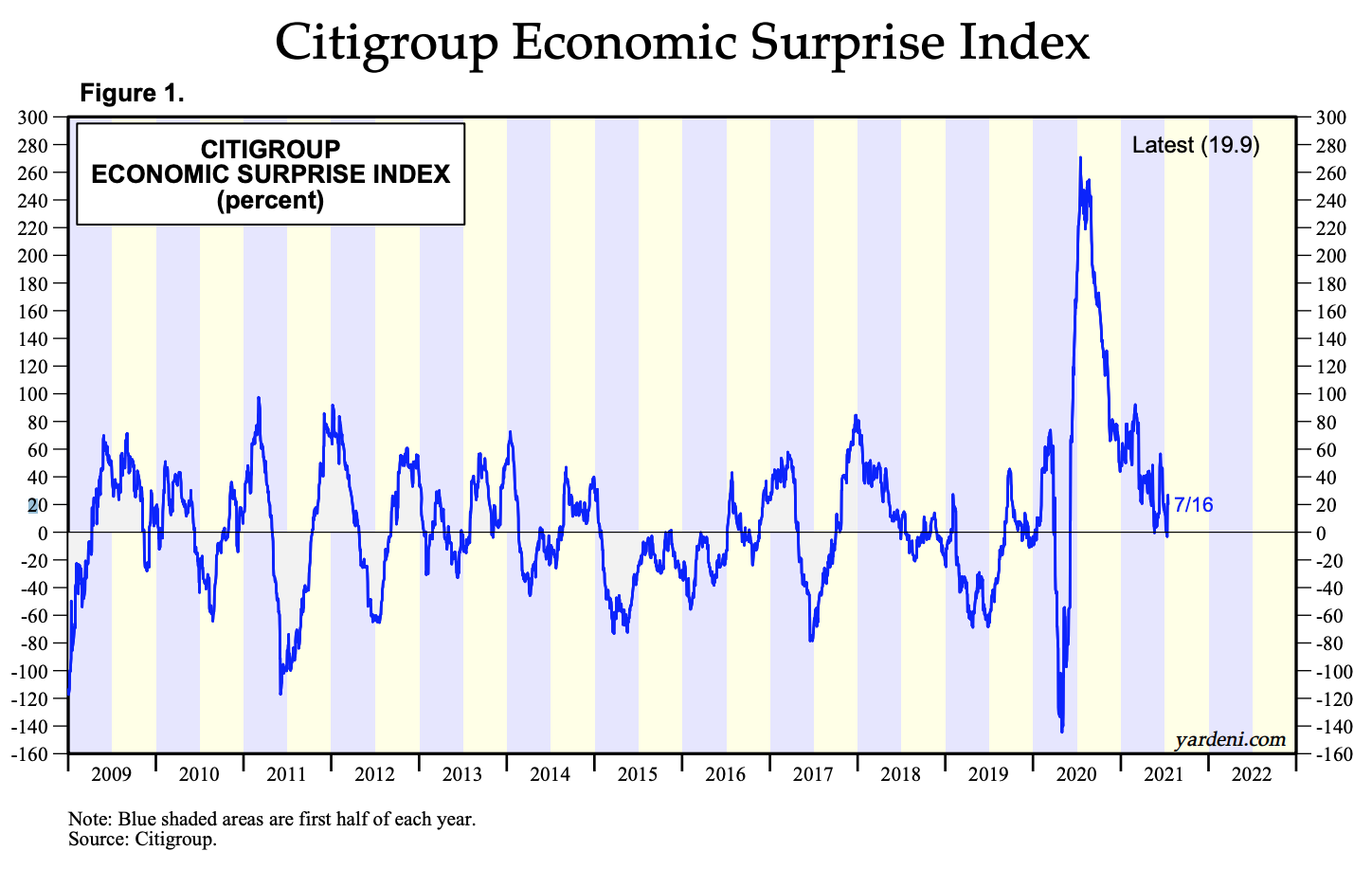

Some industries are more important than others. The evolution of the automobile industry, the construction of houses and retail sales, for example, stands out. Citigroup's economic surprise index is one of the sentiment indicators used in this group that is more focused on the near future of the economy.

- Exchange rates: Evolution of exchange rates against major currencies. Control level of exchange rate fluctuation. Real, effective exchange rates and competitiveness.

- Money markets and financial markets: This group of indicators is especially important given the strong intervention of central banks. Monetary policy is a powerful instrument and in this crisis it was especially noted. Some of the fundamental indicators are: monetary expansion indicators (M1, M2, etc), liquidity in the market. It also analyzes the level of financing by banks and consumer credit.

Money market interest rates on bonds. The yield curve. Analysis of the main stock market indices. The assessment of the stock market can be very different in the short and long term.

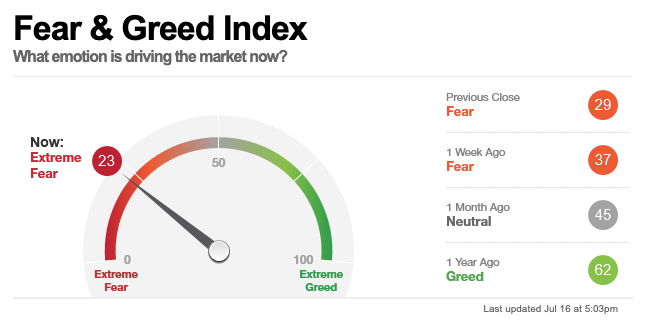

Sentiment indicators also play a role in anticipating the market trend.

In this segment, we highlight the Fear and Greed index, made available by CNN Business:

- Prices and wages (income): Consumer price indices. Oil and gold prices. Commodity prices. Wages and labor costs.

LATE, COINCIDENT AND ADVANCED INDICATORS

Lagging indicators, such as the change in GDP, for example, inform decision makers and analysts about the past performance of an asset, region or business. When the indicator is shown, the economy may be in another trend. Therefore, despite being relatively easy to produce, they are static indicators.

On the contrary, leading indicators inform analysts and investors about expectations regarding an asset or business and how we can obtain the desired results. These are dynamic indicators, but difficult to produce due to the uncertainty and sensitivity of the variables under analysis.

In the case of coincident indicators, they present the current results of the state of the economy or of an asset under analysis.

The labor market, for example, has indicators for both cases:

- Initial claims for unemployment benefits is a leading indicator;

- The payroll advertisement is known to be a coincident indicator;

- The unemployment rate is an example of a lagging indicator.

INFORMATION SOURCES

This mosaic of information is dispersed across several sources and it is not always easy to organize or produce all these indicators.

Professional platforms like Bloomberg or Refinitiv are not accessible to retail investors, or do-it-yourself investors, due to the impact of their cost and also due to the degree of specialization and knowledge they require.

On the other hand, there are many fonts whose quality leaves a lot to be desired.

Recourse to a financial advisor or research from specialists and market outlooks from institutions, organizations and wealth management companies are some of the possible solutions.

There is a whole set of institutions that produce some of the necessary indicators and that publish the respective studies and projections on their website. We highlight the following: FMI, OCDE, FED, ECB, Eurostat, BOJ, BIS, BOE, NBER, World Bank, among many others in addition to large asset managers such as Vanguard or Blackrock.

To produce the information we need, financial, statistical and econometric techniques and models are also used to project the indicators in the time horizon defined in our investment policy.

REPORT PRODUCTION AND MONITORING

The report aims to gain insight into the capital market and defined asset classes. We must interpret the given signals, the environment and the trends that the various indicators produce. It is important that it is periodically monitored and adjusted in the event of drastic changes in expectations or in the investor's own investment policy.

We live in a phase of a certain complacency and a false assurance that everything is fine and the economy will recover strongly and quickly. Faced with this sentiment, we must maintain a prudent attitude and focus on the long-term future so that the instant turmoil translates into a limited impact on the investment portfolio.

Vítor is a CFA® charterholder, entrepreneur, music lover and with a dream of building a true investment and financial planning ecosystem at the service of families and organizations.

+351 939873441 (Vítor Mário Ribeiro, CFA)

+351 938438594 (Luís Silva)

Future Proof is an Appointed Representative of Banco Invest, S.A.. It is registered at CMVM.