Individual Wealth: a behavioral approach

Do you know the value of your individual assets? Knowing the heritage, human and financial capital, together with the situational and psychological profile of each investor, is fundamental for a successful financial plan.

In this article, we cover:

- Individual heritage;

- Measure and source of wealth;

- Life stage;

- Concentration of assets;

- human capital and financial capital;

- Psychological profile;

- Conclusion.

Individual heritage

Equity is understood as the set of assets, financial and non-financial, also taking indebtedness into account. In a broader definition, it can also include the expected income and the expenses and liabilities assumed.

In recent years, counseling and heritage management have gained increasing importance. Mainly due to the complexity and the wide range of concerns and preferences that influence the decision-making process of each investor.

Therefore, we define wealth management as the activity of investment advice, which, combined with other services and financial products, aims to grow wealth in a holistic way, protect the assets of this heritage and manage the individual risk of each investor.

The purpose of the wealth management and advisory service is to help each investor answer the question of "how to invest money to achieve my goals in accordance with my preferences and restrictions".

"AJUDAR UM INVESTIDOR A GERIR O SEU PATRIMÓNIO É UMA ATIVIDADE DE GRANDE RESPONSABILIDADE E MARCADAMENTE COMPORTAMENTAL, ONDE O PERFIL SITUACIONAL E PSICOLÓGICO DO INVESTIDOR SURGEM COMO ELEMENTOS FULCRAIS NO PROCESSO DE COMO INVESTIR DINHEIRO."

Measure and source of wealth

Knowing the heritage is also knowing how it was built and what is its order of magnitude. We must therefore ask the following questions:

- Does the property held result from inheritance?

- Does it result from long-term work and systematic savings?

- Is current assets sufficient to meet future needs?

- Does it depend (the investor) on the evolution of financial investments to maintain the life style?

The answer to these and other questions are some of the resources with which we will work to build an adjusted and suitable financial plan for each investor.

Life stage

Likewise, it is also important to know what stage of life we are in. Based on 4 phases (foundation, accumulation, maintenance and distribution), the way we build and manage our heritage is totally different in each of them.

These phases that all investors go through have in common a limited resource, which is time, one of the most important factors in the construction of a successful financial plan. It has never been more important to start savings and investment activities early. Starting early, in addition to meaning starting even before adulthood, also means starting now and not tomorrow, and it applies to anyone at any stage of life.

Asset concentration

Knowing and evaluating the heritage is also vital to understand the degree of concentration of the same or which assets we may consider more or less important.

In the case of entrepreneurs and entrepreneurs, it is very common for the assets to be concentrated in one or a few assets, for example, through an interest in a company. But other investors may also have concentrated positions, such as in real estate.

At some point, it is necessary to evaluate this concentrated position, monetize it (turn it into money) or even define protection strategies.

Objectives of diversification, financial survival in the case of greater longevity and even the transfer of heritage between generations may be at stake.

Human capital and financial capital

In assessing our heritage and building a holistic balance sheet, we must also consider these two dimensions: human capital and financial capital.

- Human capital is defined as the current value of future income from work or professional activity;

- Financial capital is made up of the most physical heritage such as money, real estate, cars, financial investments, gold, cryptocurrencies, art, among others.

Taking these two dimensions into account allows us to have a clearer view of the current net worth of equity.

Psychological profile

In traditional decision-making models, we assume that investors:

- They are risk-averse;

- Have rational expectations;

They have an integrated view of their assets and assets.

But, in reality, investors:

- They are more averse to loss;

- Show to have biased (or inappropriate) expectations;

They have a segregated view of each asset that makes up their assets.

Our personality and behavior influence our decision making. Knowing this in advance, it will be easier to mitigate these implications and adjust our entire plan. This tendency to analyze the psychological profile when we talk about money and investments is today seen as essential for the management of individual or family assets.

The work of researchers such as Richard Thaler, Daniel Kahneman or Amos Tversky contributed to this evolution, which, in a way, helped to found behavioral finance.

This evolution is notorious when we verify the need to fill out a risk profile questionnaire to make a financial investment. This questionnaire assesses variables such as stability, experience and financial knowledge, investment objectives, risk tolerance and the temporal horizon. The result of the responses to the questionnaire assigns one of the following risk profiles: very conserved, conservative, moderate or dynamic.

In addition to this assessment, we also consider it very important to know our type of personality when we are faced with decision-making in an investment context.

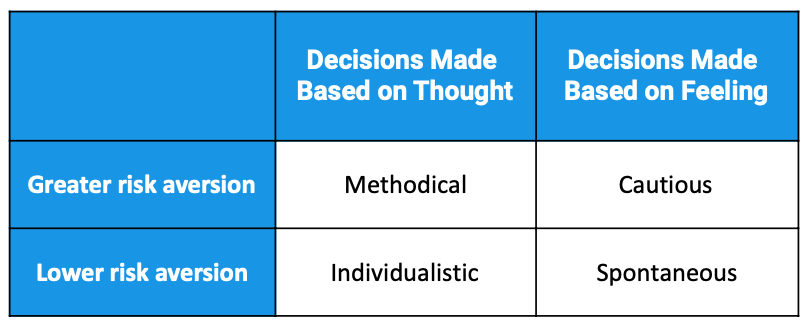

There are several approaches; but in this article, we will highlight the work developed by the CFA Institute, which compares the attitudes towards risk and the styles of each investor in decision-making between various types of personality.

What is your personality type as an investor? Cautious, methodical, spontaneous or individualistic?

- Cautious investors are generally averse to potential losses, so they look for investments with low volatility and with a low probability of losing their invested capital. Although they do not like to make decisions, they are also reluctant to seek professional advice;

- The methodical investor is based on facts. It follows market analysts and even conducts research on investment strategies. They are always looking for more and better information. They are disciplined and less emotional than average;

- The spontaneous investor is constantly readjusting their investment positions. They fear a negative consequence in every news or new information in the market and therefore they do too much trading (securities buy and sell transactions). They tend to doubt the financial advice and the help of the consultant in making a decision. They show below-average profitability due to constant transaction fees. They trust the “feeling” and are quick to make decisions. They are more concerned about the fact that they may be missing an investment opportunity than about understanding the level of risk in their portfolio;

- The individualist investor is the do-it-yourself investor group. They have an autonomous approach to investment. They look for information from various sources and analyze it in detail. They are not afraid to make a decision because they work hard. They demonstrate confidence in achieving their long-term goals.

Conclusion

People are in a relatively pessimistic phase. There are many news that show fear, insecurity and distrust in relation to the future. But the investment activity is, in itself, an optimistic activity. It is optimistic because we believe that tomorrow the world will be better, it will be more developed and we will live better.

And when we refer to investing, we may be talking about the creation of a company, the purchase of land, the subscription of a PPR or the acquisition of a lot of shares in a reference company in the capital market. Even the work itself must be seen as an investment. From its exercise we receive an interest or dividend (income) with which we can save and consume.

Knowing our heritage and our psychological profile is an attitude that is transversal to anyone, from the normal worker to the businesswoman, including entrepreneurs and business angels, and the student or retired person.

With this information, we will be able to help make decisions and better answer the question: how to invest money. For this, we use the financial market, which is our machine for updating expectations. As the place where investors and businesses looking for capital meet for both of them to meet their goals, the financial market is a leading indicator of the world in the future.

Vítor is a CFA® charterholder, entrepreneur, music lover and with a dream of building a true investment and financial planning ecosystem at the service of families and organizations.

+351 939873441 (Vítor Mário Ribeiro, CFA)

+351 938438594 (Luís Silva)

Future Proof is an Appointed Representative of Banco Invest, S.A.. It is registered at CMVM.