Asset classes in the formulation of expectations

AN ANALYSIS OF GEOGRAPHICAL AND SECTORAL ALLOCATION BY FACTORS AND TRENDS

In the process of organizing and producing expectations for the capital markets, references are regularly made to the analysis of the strategic allocation of assets in geographic terms, economic, sectoral and industrial regions and blocks, and to factors and trends in each asset class.

It is important to frame these different approaches that help to combine an investor's optimal portfolio, the different combinations in each asset class and the expectations for the financial markets.

As mentioned in the article financial market expectations, we can define several asset classes. These, in turn, can be segregated in a finer and more detailed approach into several sub-classes that can be referenced by geographic location, sector, industry, style and even specific factors or trends.

DETAILING THE ASSET CLASS OF THE SHARES

Take the asset class of stocks as an example. After defining that the financial plan must have actions, we will have to decide how we are going to make this investment.

- In a portfolio of individual stocks or through ETF or investment funds?

- In certain sectors and industries or across the market?

- In large companies or in small and medium market capitalization companies?

- In the global market or with specific weights in certain regions?

- Only in developed markets or also in emerging markets?

- Focused on value stocks or also growth?

- On disruptive topics like artificial intelligence or trends like sustainability?

It is at this stage that the formulation of expectations for the financial markets is decisive. Reconciling it with the investor's characteristics and preferences, we can choose to simply invest in an ETF or investment fund that replicates the global stock market or, on the contrary, further detail the allocation strategy to better respond to the specific needs of each investor and the result of the formulated expectations.

- Regions or countries: The options are many and can range from a broader perspective to the most granular element such as a country. Europe, Europe without the UK, European Union, Eurozone, a specific country like Germany or a European sub-region like Iberia or the Nordic countries.

- Market Type: As for the type of market it can be in developed or emerging markets.

- Style: In terms of style, we can choose actions of value, growth or a mixed style.

- Dimension: In the case of dimension, we have companies with large, medium and small market capitalization.

- Sector or industry: The result of formulating expectations can lead us to invest in a certain sector, an industry or even a specific company in that industry.

There are the most defensive and the most cyclical sectors, the sectors most associated with the growth style (growth) and the value style (value). The combination of these categories with the investment policy can add value and diversification to the investor's portfolio.

Therefore, it is necessary to understand how sectors and industries are formed. There are generally two classification systems:

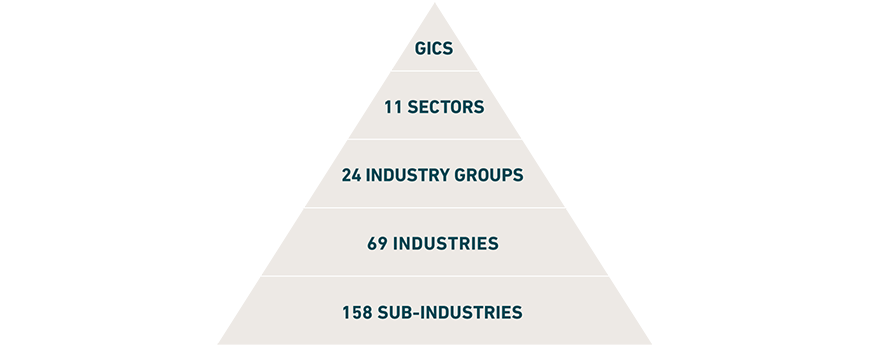

- GICS (Global Industry Classification Standard), developed by MSCI and S&P:

Source: MSCI

- and ICB (Industrial Classification Benchmark), developed by Dow Jones Indices and FTSE:

Source: FTSE

If a portfolio is built on the basis of a sector allocation and using sector ETFs, instruments that use the same rating system should be chosen so that the diversification objective is achieved more efficiently.

- Trends: There are also themes or trends that are foreseen for the future of the economy and society and that can make sense considering the objectives and preferences of each investor.

This is the case of artificial intelligence, the next generation of digital business, cyber-security, the future of transport and communications, health and technology, the blockchain, the energy transition and business linked to sustainability, climate change, water, among others.

The evolution of technology and society itself has led many companies to cross their activity across various sectors and/or industries. - Factors: We can also select based on certain factors such as liquidity, volatility, dividends, quality, momentum, ESG, among others.

THE GEOGRAPHICAL ANALYSIS

This is perhaps the most common classification for building a diversified investment portfolio and the foundation for building diverse financial products and investment alternatives.

A well-known example is the acronym BRIC, which refers to Brazil, Russia, India and China. This acronym appeared at the beginning of the 21st century with the rationale that these economies could dominate world growth in the coming decades. From here, many financial products based on this idea were built and developed, especially investment funds.

But in addition to regions, economic blocs and countries, there is also the division between developed, emerging and frontier markets, as defined by global institutions such as the IMF, MSCI, the OECD or the United Nations.

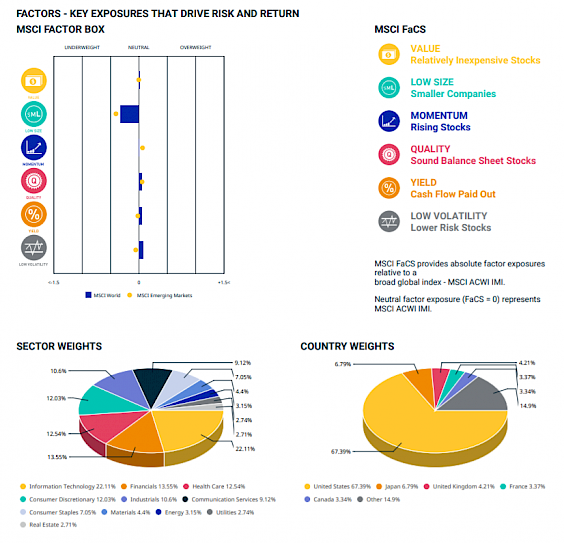

Finally, one of the most replicated indices in the world and which serves as a benchmark for many investment strategies and funds is the MSCI World Index.

In the fact sheet provided by MSCI, it is possible to see the weighting by factors, the sectoral weights and the geographical distribution by countries.

For the geographic allocation to be effective and able to diversify, it is essential that it has size, several companies in all sectors and a great diversity of companies, styles and trends.

EXAMPLE OF AN INSTRUMENT FROM GEOGRAPHICAL ALLOCATION

There are several possible combinations that cross geographies, sectors or industries, styles and dimensions, factors or trends. Starting from a geographic allocation, we were able to cross all these layers and characteristics.

For example, investing in an instrument that replicates the Stoxx 600 index, such as the Blackrock iShares ETF, or the FTSE Europe index, in the case of the Vanguard ETFs, involves investing in a wide range of sectors, industries and trends.

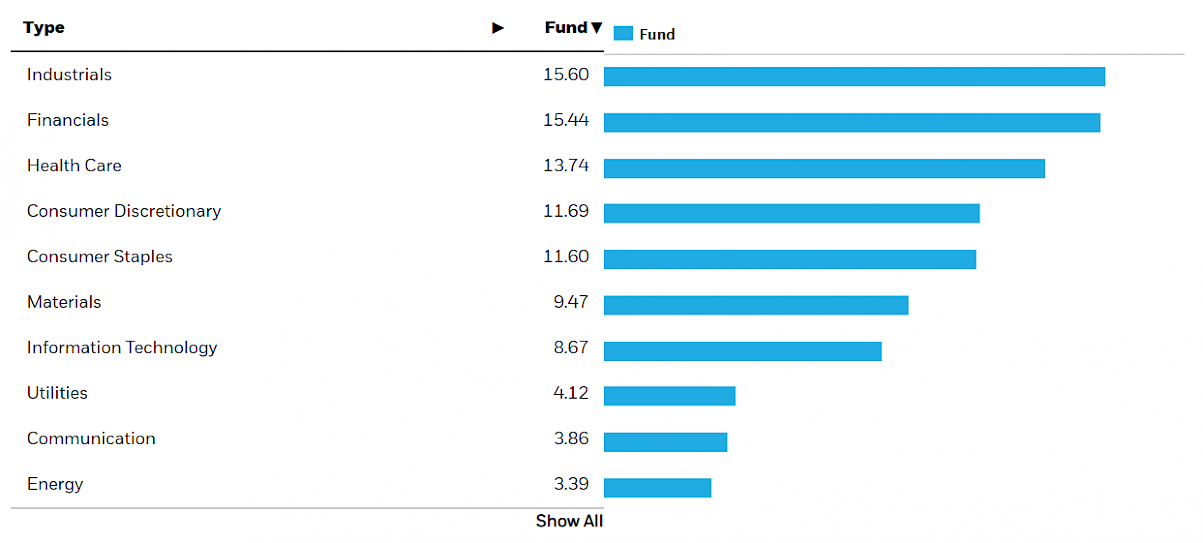

See the example of iShares STOXX Europe 600 UCITS ETF and its sector allocation:

Source: iShares

In summary, what we see is the industry organizing and reinventing itself in order to create products based on new ideas. However, the investor's interest must be a balance between this large amount of products, complexity and investment ideas and what really matters for their portfolio, as a result of the defined investment policy and what the formulation of expectations for the financial markets conveys .

Be sure to consult an advisor in this process and to build an investment policy and an adequate and personalized financial plan aligned with the expectations for the financial markets.

Let's take advantage of industry innovation and the way in which financial products are organized to make better decisions, not to increase the instability and complexity of our portfolio.

Vítor is a CFA® charterholder, entrepreneur, music lover and with a dream of building a true investment and financial planning ecosystem at the service of families and organizations.

+351 939873441 (Vítor Mário Ribeiro, CFA)

+351 938438594 (Luís Silva)

Future Proof is an Appointed Representative of Banco Invest, S.A.. It is registered at CMVM.