Do all roads lead to inflation?

Ten months after this article and this one, we return to the subject of inflation.

In recent weeks, the topic has appeared on the radar of economic publications, analysts and various economic agents. It is necessary that this information reaches people, families and organizations, so that they can make informed decisions adjusted to their situations.

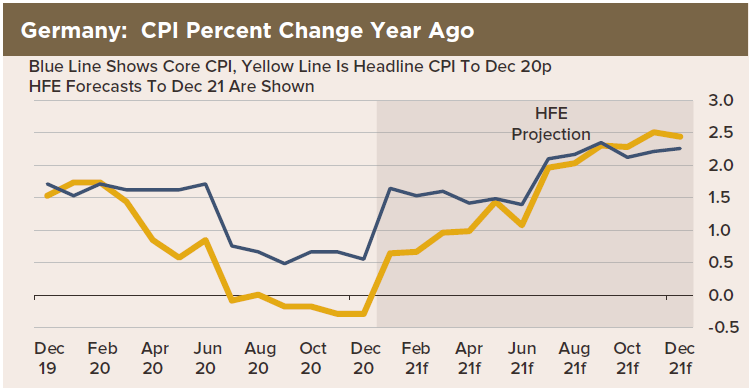

In Germany, for example, the issue has been gaining strength and concern. For 6 months the German government introduced a decrease in the IVA. This led to a fall in prices, but also a rise in consumption. If part of this consumption is maintained, and with the presumable increase in prices to incorporate the rise in VAT, we will have a rise in inflation (according to the projection of High Frequency Economics).

Source: High Frequency Economics, John Authers

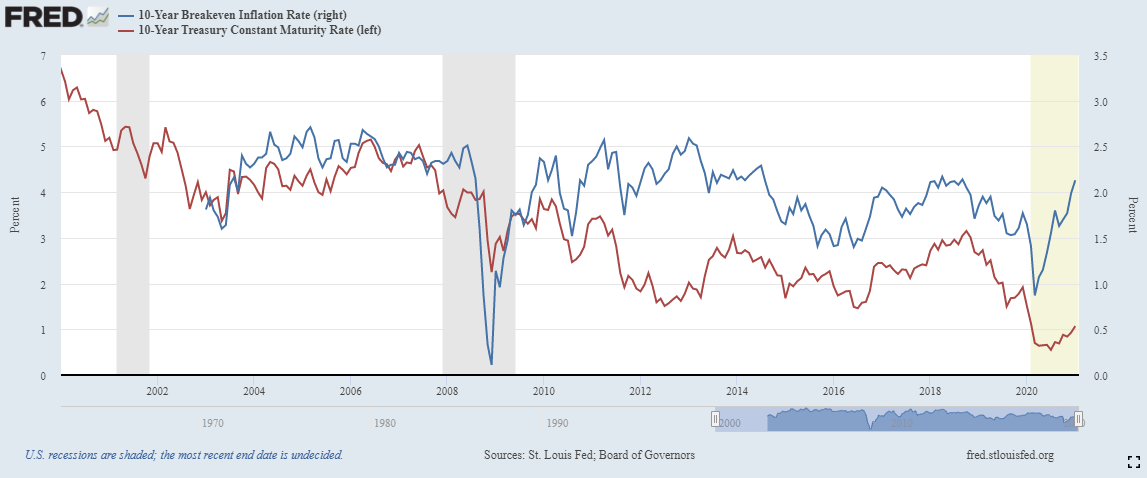

In the US, an economy that is usually more flexible and quicker to adjust, already shows strong signs in terms of inflation expectations.

Source: FRED St. Louis FED

According to the graph, we can see in the blue (right axis), the 10-year equilibrium inflation rate, represented by a measure of the expected inflation derived from 10-year US Treasury bonds. The value is already above 2% with a rapid rise in the last 12 months, contradicted until the behavior of the 10-year interest rate on bonds, which has been rising, but slowly.

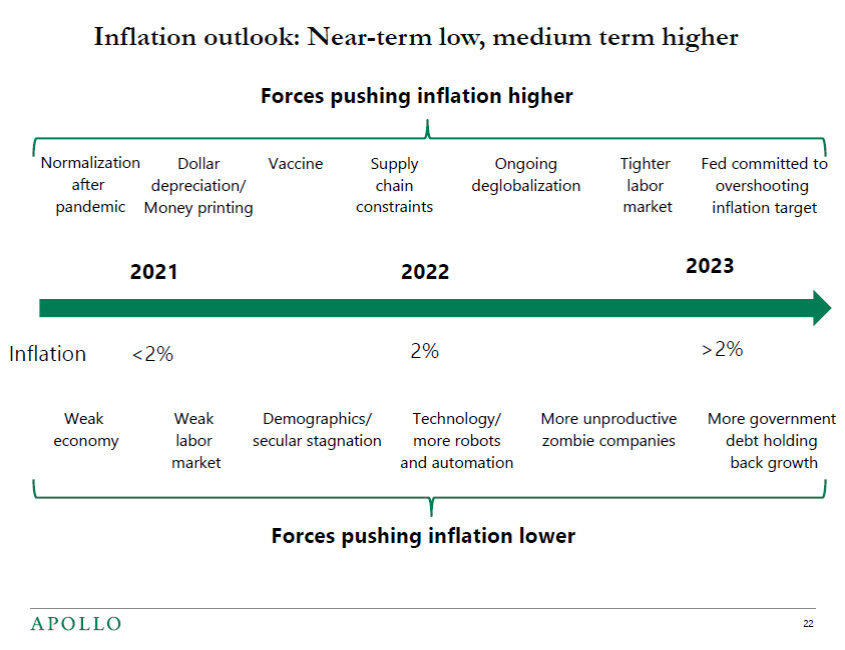

Let's look at more arguments in favor of the inflationary perspective.

Commodities

Let's start on the side of raw materials (commodities), such as agricultural. Prices are rising sharply in the short term, which will naturally be reflected in food prices.

On the oils side, the deflation caused by long months of pressure on the price seems to have been overcome, even with this new wave of confinements.

Commodities are especially important in this analysis. A price rise tends to last more than a decade, long cycles - Kondratieff Wave. The stock market also tends to move in long cycles (bear and bull cycles) and, normally, the signal against commodities.

Rising commodity prices directly consume profits, leading to a rise in inflation. The very long and continuous rise in stock prices ultimately tends to mean, sooner or later, a stronger demand for commodities. Shares rise based on expectations that, in the future, company profits will be better than current ones.

CRB Index: Refinitiv/CoreCommodity CRB index

This scenario of rising inflation may be the most likely if we also take into account that China is leading this economic resurgence, accompanied by its Asian peers. This growth model is also linked to raw materials and liquidity. China, with strong growth in 2020, is clearly in an expansionary mode.

Strong commodities also mean better prospects for emerging markets and their currencies, reinforced by a weakening dollar. Emerging markets benefit from the ability to export natural resources.

Another factor to strengthen the inflationary scenario is the COVID-19 vaccine. Once the logistical problems have been resolved and the pandemic has been resolved, it is natural that consumption will increase rapidly and part of the accumulated savings will be inserted into the economy.

Finally, from the side of the arguments for increasing inflation, we have the trend of deglobalization. This trend was not born with the pandemic, but was strengthened by it. Nationalist political impulses mean less productivity, less economies of scale, less innovation, less competitiveness, less diversity, less wealth, less supply and, therefore, more inflation expectations.

This apparent tiredness of the improvement in living conditions caused by globalization has grown alongside another trend: the large digital monopolies. There is a need to face a problem arising from a decade of digitalization of social life. A private monopoly can be just as problematic as a state monopoly. The competitive balance must be strengthened. Free and democratic societies are if we are able to guarantee our personalized and altruistic existence, not controlled by any totalitarian state or business power.

But there are also signs contrary to inflation. Let's talk about them.

One of the most referred to is the labor market.

If we pay attention to the non-growth of wages and the signs of the layoff, the rate of unemployment so high and with so many unforeseen events related to the pandemic, inflation may not be a real problem in the coming years. It will be controlled, but it will certainly affect the allocation of resources and the valuations of risk assets.

Other arguments are demographic stagnation, mainly in Europe, the increase in robotization and technology, the maintenance of inefficient and unproductive zombie companies in the market, and the increase in public and private debt, which hinders growth. This last reason may not become evident yet, as interest rates are low and the market decided to postpone the problem.

The role of central banks

Putting all these arguments into perspective, the role of central banks emerges. Their focus on raising inflation should remain unchanged.

Not withdrawing the stimuli too quickly or too soon seems to be the objective. This gives confidence to the market to continue the process of recovery and discovery of the future of the economy.

But, as John Authers points out in his newsletter on the Bloomberg Points of Return, on the European side, the strong euro shows the limits of the ECB in dealing with deflation.

Michael J. Howell, in his book Capital Wars, The Rise of Global Liquidity, on central banks shoots: "Don't Fight the Fed, Don't Upset the ECB and Don't Mess with the PBoC." He also mentions that liquidity grew by around 25% of world GDP in a few months and that economic recoveries have been faster and faster.

And, contrary to what you might think, this sea of money will also be spent to buy goods and services in the real economy and not just to inflate capital markets.

This separation, always much discussed, reveals the existence of two large blocks: financial assets and the real economy. We know that both influence each other and are not mutually exclusive. The balance between both is important and a sign of development and well-being.

If, at first, the liquidity generated by central banks goes to the financial market, recovering it, then it reaches families and companies. And it is these agents who continue the recovery, which is now economic. This connection is becoming faster and more effective. This crisis may have accelerated this process as it practically forced the various economic agents to save, to postpone investment and consumption, and then allow them to do so practically simultaneously. This after, virtually, and in the sectors that were possible in this way, this recovery has already been felt. It is natural that the traditional sectors with less digital depth are, however, the next ones to embark on the recovery.

Bringing together all these arguments, trends and perspectives, and even such exponential growth in the liquidity available in the market, we can and should expect investment and consumption to return in force, even if only momentarily, as soon as it is viable in terms of health.

There are many contradictory signs. There is daily noise and erratic data. But we cannot devalue the information!

➤ Doubts? Opinions? You can discuss this article on LinkedIn.

Vítor is a CFA® charterholder, entrepreneur, music lover and with a dream of building a true investment and financial planning ecosystem at the service of families and organizations.

+351 939873441 (Vítor Mário Ribeiro, CFA)

+351 938438594 (Luís Silva)

Future Proof is an Appointed Representative of Banco Invest, S.A.. It is registered at CMVM.