What you must know about investment funds

An investment fund is a form of investment managed by a professional management company, whose objective is the collective investment of money obtained from individual investors.

In this article, we are going to talk essentially about securities investment funds, that is, funds that invest in listed or unlisted financial assets (stocks, bonds, money market instruments, raw materials, among others).

In addition to securities investment funds, we also have venture capital funds, pension funds and real estate investment funds.

Investment funds have their origins in the second half of the century. XVIII, in the Netherlands. However, the first investment fund of the modern era was launched in the USA almost 100 years ago, in 1924.

Viewed as an innovative and democratic form of investment, investment funds allow small investors to access virtually any market or region or asset in a diversified and professional manner at a low cost.

Main features:

- An investment fund is considered an autonomous asset;

- In the US the most used term for investment funds is mutual funds while in Europe the SICAV structure or open investment company in the UK is used;Any investor can access diversified and professionally managed portfolios for a low cost;

- There are several types of securities investment funds that can be adjusted to the investor's profile and to their goals and preferences;

- The cost structure of an investment fund may involve management fees, transaction costs, operating costs of the fund (it operates like a company), performance fees and other fees charged to the fund. In most investment funds there is no subscription or redemption fee;

- An investment fund is divided into several classes, namely, and simply put, the retail, investor and institutional classes. These classes have different cost levels. For the small retail investor, the normal is to be available in the retail class, whose management fees are higher, as they include distribution commissions;

- To invest in an investment fund, investors subscribe for units of that fund, becoming participants in the fund's performance in proportion to their participation;

- Mutual funds usually have a daily quotation, at the close of the market and when we subscribe or redeem participation units in an investment fund, we do not know the quotation, as this is usually the following day (T+1) or the of the day (D) and depends on the time of sending the subscription or redemption order (if before or after the daily closing time – cut-off – of the fund).

As can be seen in the graph below, the assets under management of regulated investment funds in 2020 already exceeded 63 billion dollars.

Types of securities investment funds

There are several ways to classify investment funds.

The investment funds available to retail investors are open-end funds, that is, funds whose capital varies according to subscriptions and redemptions carried out. However, there are also closed investment funds, that is, fixed capital funds with participation units to be defined at the initial moment or under certain pre-established conditions.

One way to classify investment funds is according to geographic criteria.

As a tied agent, Future Proof provides investors, through the Banco Invest platform, with a very complete investment fund research tool. Using the technology and database of Morningstar, one of the world's leading investment fund analysis companies, it is possible to search through various criteria.

Asset class

- Stocks - namely taking into account

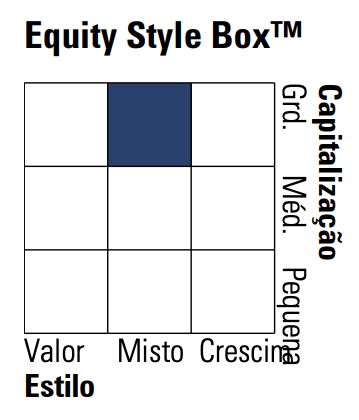

- The style – growth, value and blend (stock fund that combines the value and growth styles

- And the market capitalization – small, medium and large market capitalization.

In the following image, we can see how Morningstar presents an equity investment fund in terms of style and market capitalization, in this case in terms of Fidelity Funds - World Fund E-Acc-EUR.

- Bonds – credit quality is one of the main differentiating criteria. Through the division according to rating, it is common to find bond investment funds investment grade (rated BBB or higher, according to the rating agency of Standard & Poor's) or high yield (rated below BBB, according to the rating agency). Standard & Poor's rating).

- Treasury – or monetary investment funds. They are low-risk funds, which invest in short-term, highly liquid debt assets such as time deposits, commercial paper, treasury bills and corporate or treasury bonds with a short maturity.

- Mixed – are investment funds whose strategy involves investing in two or more asset classes, such as stocks and bonds;

- Others – alternative strategies, commodities, direct or indirect real estate.

It is also possible to have flexible funds, whose management has greater freedom in terms of investment policy, and funds of funds, when the fund invests in units of other funds.

A sub-category of investment funds are index funds. This type of fund is based on a passive market strategy. They require less research and analysis and are therefore cheaper than traditional mutual funds.

Geographic allocation

In this category, the available options are numerous. There are options for virtually all developed countries and most emerging countries.

There is also allocation by regions or sub-regions, such as the EU, Asia Pacific, or BRIC (an acronym that emerged at the beginning of the 21st century to bring together the economies of Brazil, Russia, India and China in an investment trend).

Within the EU bloc we can have, for example, Iberian investment funds. In Europe we can have investment funds without or with the United Kingdom, only from developed markets or 'emerging markets, from the West or the East.

Sector allocation

Sectoral allocation allows an investor who wants to gain exposure to stocks, to define the type of sector in which he wants to be invested. Funds are allocated to this category according to the sector with the greatest weight. The most common sectors are: consumption, energy, finance, real estate, industrial, natural resources, health/biotechnology, telecommunications/media/technology and utilities.

Currency

O fundo de investimento pode ter investimentos em diversas moedas e o próprio fundo pode estar disponível em diversas moedas com ou sem proteção cambial.

Um fundo de investimento cuja moeda de origem é o dólar americano, pode incorporar custos adicionais para ser cotado em EUR com proteção cambial, ou seja, para que a rentabilidade do fundo não seja impactada pelas variações cambiais entre EUR e USD.

Dividends

In this case, we may have investment funds with periodic distribution of income or accumulation.

Finally, already mentioned in this article on financial products where to invest money, we have the harmonized and non-harmonized investment funds.

Benefits and Disadvantages of Investment Funds

Benefits:

- Diversification, through the combination of several investments and assets in a portfolio, promoting risk reduction;

- Liquidity, the investment fund has great freedom of movement, both in subscription and redemption;

- Easier access and economies of scale, the investor has access to a huge set of markets that would otherwise not be possible due to the high amounts involved. It also allows for a simple and safe investment at reduced prices;

- Professional management. the portfolio is managed by a professional entity, removing the need for analysis and selection of assets from the investor;

- Wide variety and freedom of choice, as there are countless possible solutions and combinations to invest;

- Transparency, through a regulatory framework that introduces security and confidence to investors.

Disadvantages:

- Fees can be too high and incorporate conflicts of interest;

- There is no capital guarantee and no access to the deposit guarantee fund. The fund's capital can vary greatly;

- Due to the wide variety of funds, it is difficult to compare the different strategies;

- It is not always possible to have access to the complete investment fund portfolio;

- The amount of money available in the fund resulting from the dynamics of subscriptions and redemptions may result in lower returns.

Due to the huge offer of mutual funds, sometimes the most difficult thing is to select the best investment fund in the category or those that are best suited to our strategy. We should look at the fund's cost ratio (total expense ratio) and performance measures such as the Sharpe ratio (risk-adjusted return level), in addition to alpha (excess return compared to a benchmark) or beta (sensitivity fund against market risk).

Investment funds are associated with active management, that is, with the manager's objective of beating a certain index or benchmark. The truth is that investment policies are so different that it is difficult to compare funds even within the same category.

In qualitative terms, we highlight the volume under management, the amount of liquidity available, the rotation of assets in the portfolio (more rotation means more transaction costs and possibly worse performance) and stability of the management team.

At Future Proof, through our order reception and transmission services and investment advice, we can analyze and select these instruments. We use our own tools and those available in the investment funds section of Banco Invest, where you can find a set of essential indicators, information and documents relating to the investment fund you are analyzing.

Despite their longevity, investment funds continue to be a very attractive instrument and of enormous interest for any investor. They enjoy enormous flexibility, allowing any investor to build a portfolio entirely tailored to their needs and taking into account the specificity of the return and risk objectives and respective preferences.

Vítor is a CFA® charterholder, entrepreneur, music lover and with a dream of building a true investment and financial planning ecosystem at the service of families and organizations.

+351 939873441 (Vítor Mário Ribeiro, CFA)

+351 938438594 (Luís Silva)

Future Proof is an Appointed Representative of Banco Invest, S.A.. It is registered at CMVM.