The importance of savings

The concept of savings refers to the money that we put aside after we withdraw the expenses from our disposable income, during a certain period. We can also associate savings with insurance, a way of transferring risk, an option about the future.

From an economic point of view, and taking into account the type of society in which we operate, where consumption plays an important role in our routine and in the economic model, the concept of savings can also mean postponing consumption.

It is true that savings contribute to our financial well-being and to our lifestyle in the present and the future.

Savings = postpone consumption => The difference between disposable income and what we consume.

SAVING AS A PRIORITY

Savings is one of the essential resources of the financial plan. It is a kind of renewable energy that needs to be fed periodically.

Therefore, we must define savings as a priority: Pay yourself first!

What does it mean to set saving as a priority?

It is an act of entrepreneurship. Means:

- Put savings ahead of consumption

- Define how much we will save and only then define how much we will spend on consumption.

- This perspective helps us make better decisions and more easily achieve our goals.

So let's consider three reasons to save:

- Achievement of objectives;

- Establishment of an emergency fund for unexpected situations (that happen);

- Personal satisfaction. To build our invisible heritage that allows us to consume and maintain the style of life in the future.

There is a wide range of literature and publications to teach you how to save and even tips on how to become rich. Several books with so-called foolproof tricks on how to invest in the style of Warren Buffet or how to make money on the stock exchange.

However, it is rare to find books or studies that teach how to maintain or manage the accumulated savings and how difficult it is to be rigorous, systematic and patient.

That's why it's so important to always have savings as a priority. From our periodic income, the first one to pay is ourselves: Pay yourself first!

SAVINGS AS A VEHICLE FOR FINANCIAL INDEPENDENCE

Savings are made in cash. Then, we have to select the investment instruments or typologies to invest this money and go against the defined financial plan.

These instruments can be time deposits, investment funds or ETF, PPR, insurance, direct investment in a portfolio of stocks, bonds or commodities. But also alternative investments, real estate investment, art or other instruments that enable the remuneration of invested capital in accordance with our tolerance for risk and preferences as investors.

The time needed to achieve our goals depends on the amount we save and how we invest. The element that we can best control is the amount of savings. This, to be higher, means that we will have to cut back on consumption.

This notion of consuming only what is necessary is related to FIRE – Financial Independence, Retire Early - a movement that emerged in the US at the beginning of this century and that advocates financial independence.

Some of the features of this movement can be well adapted to each individual, taking into account their situation, their goals and preferences. Basically, the individual financial plan.

Main features of FIRE:

- Frugality, extreme savings and investment;

- Savings of up to 70% of the annual income;

- Savings goal: 30 x annual consumption;

- Small withdrawals from the savings accumulated after the retirement.

The most important conclusion of this concept is that the time until retirement significantly decreases if the amount of savings, or better, the rate of savings over disposable income, rises.

MAIN CONCEPTS ASSOCIATED WITH SAVINGS

One of the best known investors is Warren Buffett. We know his success and we know his enormous fortune. But one of the aspects that we should emphasize in your example of him is patience. Buffett is a patient investor, who was in no hurry and who always considered time as the main secret of his savings and investment process.

At 65 his assets would be something like $3 billion, but it's been in recent years that his savings have grown the most. The Omaha Oracle currently has an estimated wealth of over $100 billion. What is the secret? Start early, still a teenager, and continue the process until today.

With this example, we were able to understand the importance of the investment period, but mainly of the capitalization effect, what we often call “interest interest”, the compound interest. Unlike simple interest, compound interest also takes into account the interest accrued in previous periods.

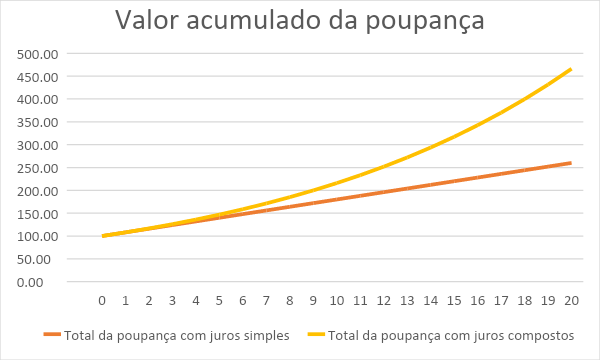

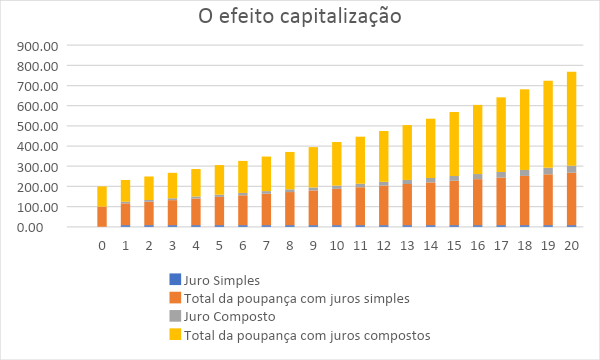

The following and graphic table exemplify the importance of several concepts:

- The investment period, in this case 20 years;

- The interest rate or expected profitability, which was considered 8%;

- And the reinvestment of interest or income from the investment;

- The initial value is €100 without any reinforcements.

In the yellow line, interest or income were reinvested at the same rate of return at the end of each year. In the case of the red line, the simple interest was not reinvested, but only accumulated at the initial value.

As we can see the capitalization effect, that is, the result of annually reinvesting the income generated by the investment made, generates an accelerated growth of our initial investment. In 20 years, the result is practically double that achieved based on simple interest, that is, the non-reinvestment of interest.

With this example we were able to highlight the importance of having the financial mathematics on our side and taking advantage of the wonders of capitalization. When we prepare a savings plan, we must take this and other fundamental concepts into account, such as the expected rate of return, the associated risk, diversification, the investment period and what types of instrument we will use to materialize the savings.

But there is always an inconvenient truth that we must be prepared for – we can give and receive all the knowledge in the world, but we will continue to make the wrong decisions. Knowledge is not the only variable needed to change our behavior. We know that sugar or alcohol are not good for us, but we continue to consume them. It's just that the emotional component is more difficult to correct. They are errors and bad decisions that result from reasoning based on feelings, impulses or intuition.

In savings, being aware of our limitations and weaknesses is essential to maintain focus and discipline. Be patient right away and define a new routine: pay yourself first!

Vítor is a CFA® charterholder, entrepreneur, music lover and with a dream of building a true investment and financial planning ecosystem at the service of families and organizations.

+351 939873441 (Vítor Mário Ribeiro, CFA)

+351 938438594 (Luís Silva)

Future Proof is an Appointed Representative of Banco Invest, S.A.. It is registered at CMVM.