Is Real Estate investment worth it?

With the strong valuations of the real estate market, it is normal to ask: is the Real Estate Investment still worth it?

The same question can be asked for virtually every type of investment: stocks, bonds, raw materials, cryptocurrencies, deposits, and even real investments like art or wine.

The reason for focusing on real estate is related to its very unique characteristics, the importance it assumes in the global wealth of families and the risks it entails and which are often undervalued. Is the bubble feeling, in fact, well evident in news made available in various publications such as Real estate bubble in Portugal and Europe? What do Eurostat data say, Rise in the price of houses for sale is here to stay - yes or no?, based on a study by S&P Global and the impacts that real estate could have on house prices, The evolution of house prices in Portugal in the last three years, or even this article by Gonçalo Rodrigues, on the Out of the box website, about yields in the Porto housing market, which are falling sharply.

It is common to hear: “it is better to invest in property, something tangible, than in the stock market”.

Real estate can and should be part of individual assets. It has essential characteristics for a diversified and goal-oriented portfolio and is a good inflation protector, for example. In fact, in inflation scenarios above expectations, such as the current one, we should favor investments whose appreciation or yield is somehow indexed to inflation, and real estate is one of them. But there are also bonds indexed to inflation and even sectors and companies that benefit from inflation and that manage to raise prices, passing the inflation on to consumers.

However, having a diversified real estate investment portfolio implies having considerable value to invest. And when we refer to diversified, it means investing in several properties that have a low correlation between them, from different sectors (tourism, residential, business, agricultural, forestry, for example) and regions. Therefore, it may make sense to use the financial market to diversify property investment, for example, by subscribing to a property investment fund. There are already several available in Portugal, allowing an investor, from the smallest to the largest, to be able to invest in a diversified manner in real estate, literally all over the world.

But the immediate answer is: "But the property is not mine!"

Right, when we invest in real estate investment funds we are buying participating units. In fact, we own part of the property stock and not a property. However, on the other hand, we were able to invest in several properties and not just one or two.

But the profitability will be much lower!

Well, it could also be true. We know that the greater the concentration of investment, the greater the risk. Of course, the potential for profitability could also be greater, but it is uncertain.

In fact, the topic of concentration is interesting. If we have strong convictions, some luck, and good analytical skills and insight, concentration can be highly profitable. It is enough to see that many of the great fortunes were built based on investments in a company, in an idea. There are many entrepreneurs who have their assets concentrated in their business because, they say, they cannot get a better return on their capital in another business. The truth is that even in this scenario, the issue of return must be analyzed carefully, with a risk perspective and with the expectation of future results of the company. This without jeopardizing the family's own heritage and future.

Monetization and investment concentration

Therefore, we talk about monetization, whether in the case of real estate investment or in the case of concentrated investments. Monetization is fully related to the ability to transform an asset into liquidity. Transforming into liquidity can be important to, there it is, diversify, but also due to sudden or emergency need, to transfer assets and even to invest in other businesses. The financial market is also important here, as it has the necessary instruments and characteristics to carry out these operations.

Thus, real estate investment has another added risk, which is illiquidity. A diversified ETF portfolio, for example, typically provides immediate liquidity as long as the market is open. There is always a price available to negotiate. A property is not like that. The sale doesn't happen when we want. It should be noted that the volatility of investment in the financial market comes precisely from the fact that it is available in real time to carry out transactions. There are millions of people interacting in a market, to buy and sell, with different interests and goals and, therefore, it is natural for the price to fluctuate. In a property transaction, at most, there is a seller and some potential buyers. It is normal to have much less perceived volatility, as there is no daily quote, nor are we constantly looking at the graph of the evolution of the property we have just purchased or asking for expert appraisals. When we buy a property, it is normal to have a medium and long term perspective. Instead, when we buy a stock we can even sell it on the same day. This creates volatility and brings emotion to the business, which is not always positive.

Still on illiquidity and volatility

Before we go any further, a parenthesis just to refer that volatility of an asset is a measure of risk that measures the variation or dispersion of the profitability of that asset. The greater the variation, the greater the possibility of winning or losing money.

In addition to real estate investment trusts, there are REITs (real estate investment trusts) popularized in the US and later in the rest of the world. In Portugal they also exist in the form of SIGI (Investment and Real Estate Management Companies). These instruments are companies listed on the stock exchange whose main objective is the acquisition of real rights over real estate, as well as holdings in other companies or investment funds for lease.

REITs are very liquid instruments and incorporate in their quotation all the sentiment of investors at the time and, therefore, volatility is very similar to instruments such as shares, mutual funds and equity ETFs.

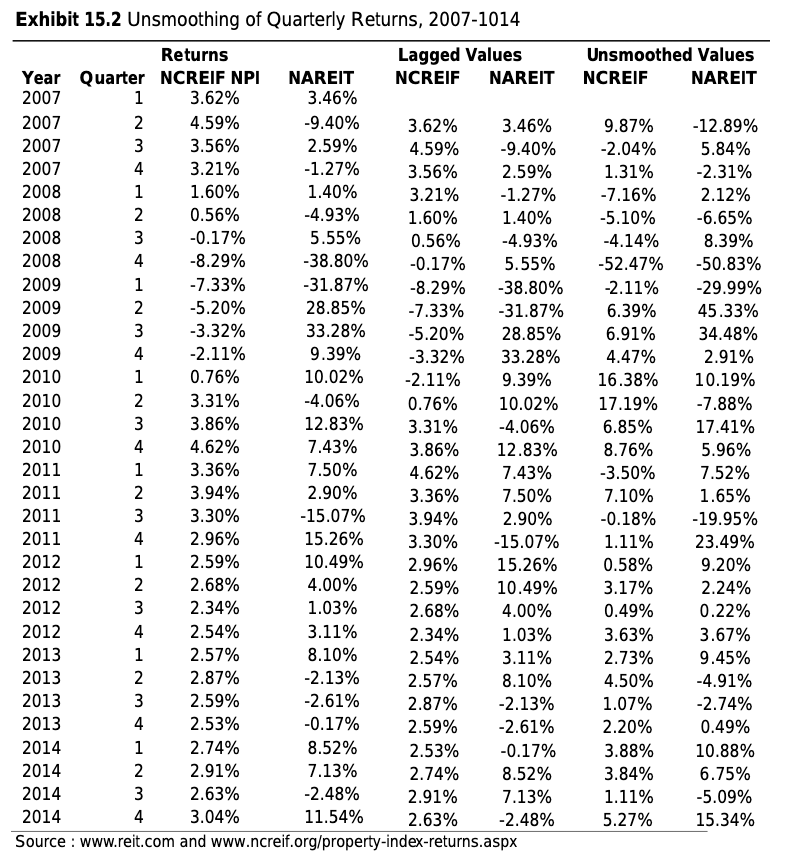

Indeed, this study by Urbi Garay, Real Estate Indices and Smoothing Techniques, illustrates the issue of implied volatility in real estate. The author used data from the American real estate market, due to its magnitude and history, namely the real estate index NCREIF - National Council of Real Estate Investment Fiduciaries - and NAREIT - FTSE National Association of Real Estate Investment Trusts US Real Estate Index Series.

The NCREIF is an index based on valuations of private properties and therefore with an apparent smoothing (smoothed) of the property price and its variation. The NAREIT is based on the market prices of REITs traded on the stock exchange and reflects all information available on the market. According to the study, the average return is similar in the 2 indices, but the volatility of NCREIF is substantially lower than that of NAREIT. Through statistical and mathematical techniques, the author purged the smoothing of the NCFEIF index (NCREFI unsmoothed), having concluded that the real volatility is three times higher than that perceived by investors, approaching the normal volatility of a stock index and even REITs which, as we have already mentioned, are listed on the stock exchange.

Even so, REITs have a slightly higher volatility, which is explained by the issue of leverage, that is, the use of debt to carry out the investment. NCREIF is based on debt-free real estate investment.

Still on the issue of leverage, it is worth mentioning that much of the real estate investment is made with recourse to financing. This situation can enhance gains, but also losses. We know what happened in the great financial crisis of 2007-2009 caused precisely by a housing bubble and the debt associated with that investment.

To conclude this analysis, look at the following table with the quarterly profitability of the aforementioned indices, smoothed and unsmoothed version, and pay attention to the falls in 2008 and rises in 2009. This situation helps to explain what we are referring to perceived and real volatility . Real estate investors who invest directly look different from real estate investors who invest indirectly through REITs or real estate investment funds. But they are not.

And the income we receive from the investment?

Income is a bit what we call dividends or interest when we invest in the financial market, in stocks or bonds.

In both cases we are subject to tax and the fact that the company or the lessee fails to pay the dividend, interest or rent, respectively. But here too, real estate investment carries an increased risk. If we have 1 or 2 apartments in our portfolio, we have to rely on the rotation of tenants, in the absence of rent for a few months, maintenance costs, possibly condominium fees and taxes such as IMI, which are fixed even if the property is closed. In the financial market, we managed to eliminate some of these risks, from the outset by the potential for diversification that investment funds or ETFs offer, greatly reducing the risk of default or delinquency in our investment.

In fact, there are those who compare real estate investment with investment in bonds. And indeed, there are some similarities. However, as we saw above, given the implied volatility, this is perhaps more like investing in stocks. The point we want to reinforce here is that they are different investment typologies, both valid and that must be part of an investment portfolio, always taking into account the objectives, preferences and restrictions of each investor in addition to market conditions and expectations long term.

But at least the property I can control unlike an ETF

The feeling of control is linked to ownership and can give a false sense of security. If we focus on the question of ownership, it is equivalent. In the same way that we own property, we can also say that we own some units of an investment fund, shares of a company or shares of an ETF. In principle, depending on the financial intermediary we use, the registration of these financial instruments is done in our tax number and, therefore, we are the holders/owners.

And in Portugal, is it still worth it?

The fact that real estate in Portugal has been, and is being, an excellent investment reveals that there was a lack of real estate investment, after a few years of stagnant and even falling years, namely between 2010 and 2013. The search for income, savings accumulated and foreign investment help explain the good moment.

But let's take a look at the profitability of the real estate market compared to the stock or bond market.

After several years in decline or stagnant, the real estate market recovered in the wake of tourism, recovery and real estate and new construction, both in terms of business and residential properties. This trend accelerated with the pandemic, as a result of new needs, changes in lifestyle, new teleworking habits and also driven by an increase in household liquidity.

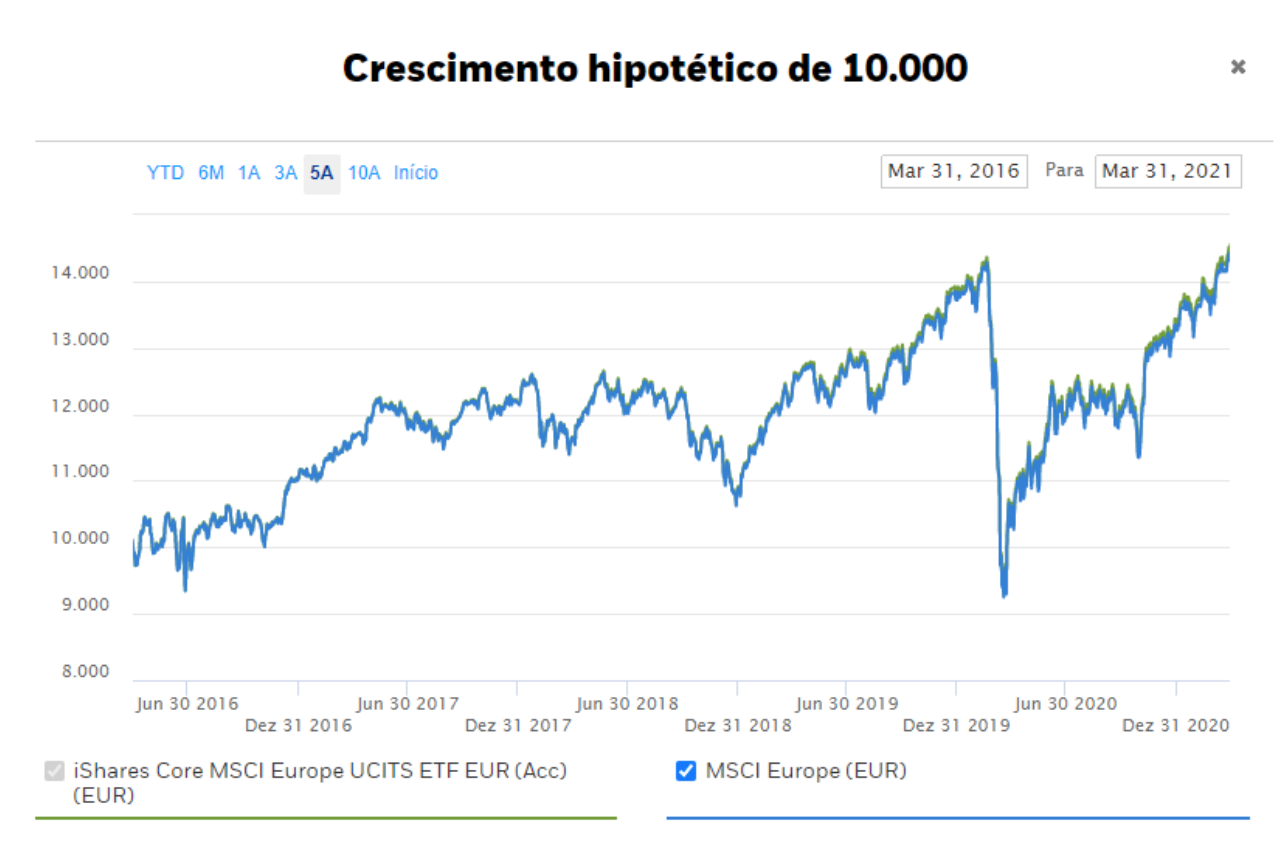

According to Eurostat data, the average price of housing in Portugal has grown by more than 6% per year in the last 5 years. In fact, according to data from INE, real estate price growth was 44% between the first quarter of 2016 and the first quarter of 2021. And how the share index behaved. The PSI 20, in the same period, grew about 17% (not counting dividends). This disparity and the lack of confidence and development in the capital markets in Portugal help to explain the Portuguese investor's bias towards real estate, and with good results, let us say. However, if we analyze a European index such as the MSCI Europe (on the Blackrock website), in the same period, we obtain a return of approximately 45%, in other words, similar to the evolution of real estate in Portugal. It is clear that this analysis is simplistic as it does not take into account the taxes and costs associated with the two types of investment. In the case of real estate investment, the cost of deeds and registrations is very relevant, not to mention maintenance costs and taxes.

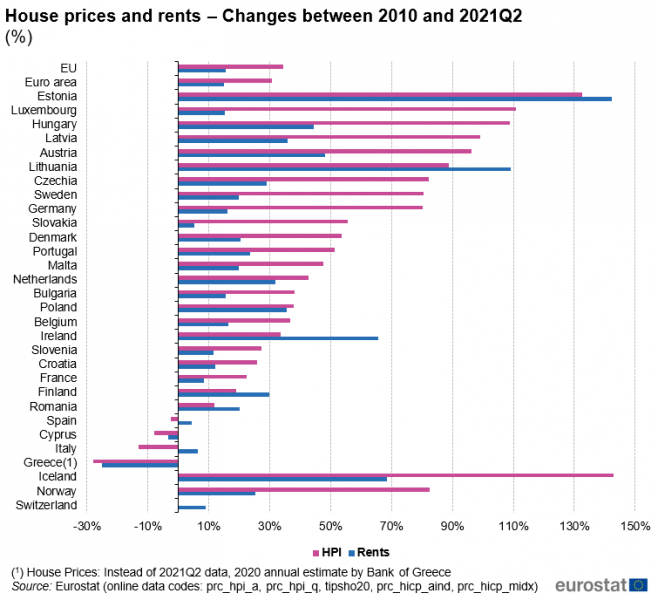

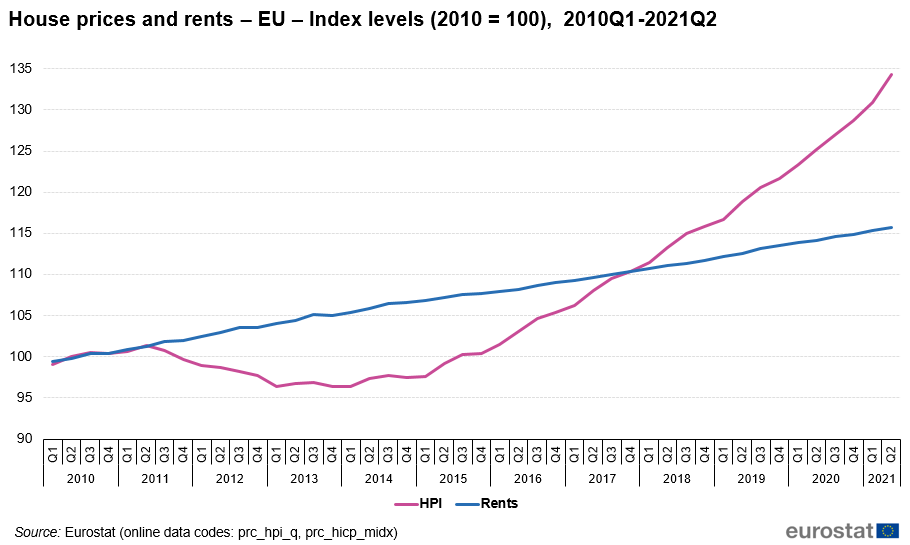

There was and is also the false feeling that real estate never loses value. The graphs below show the evolution of house prices and rents since 2010 and, in some countries like Spain or Greece, the scenario is not famous.

This chart shows that the value of properties grew much more than the value of rents. It should be noted that the total return on an investment includes not only the price variation, but also the associated income (rent, interest or dividends). This case demonstrates that the rise in prices can be explained by the lack of investment alternatives, the natural Portuguese and even European predilection for real estate investment, the sharp drop in interest rates, excess liquidity and accumulated savings, among others.

According to JLL data, “prime yields remain stable, with minimum levels in several sectors, namely 4% in the office market, 4.25% in high street retail, 5.75% in the industrial and logistics market, 5 .25% for shopping centers and 6.5% for retail parks”. These implicit rates of return are gross tax rates and, in some cases, some maintenance costs as well. Even so, these values are much higher than those registered in Europe, such as in Switzerland, where yields are already at values below 2%. And they are also higher than term deposit rates or savings certificates and higher-rated bond interest rates.

The illiquidity of the real estate market must be a premium, that is, the yield implied in real estate must be higher than traditional more liquid investments. It is natural for investors to demand a superior return precisely to overcome these constraints associated with real estate.

Conclusion

In summary, this article is not intended to advise against real estate investing. On the contrary, we only try to highlight the importance of investment via the financial market and diversification. Both are important and each has its specific role. Don't be influenced by the noise of the news and the moment. Build a diversified portfolio by taking advantage of the benefits of both assets, the more real market such as direct investment in real estate, and the financial market, through its potential for diversification, long-term growth and liquidity. Make sure that diversification is done based on the correlation between different assets. Investing in many assets does not mean diversifying. Diversifying means investing in assets that have different characteristics and that can bring benefits in different market situations.

Investing in property is different from investing in the stock market and one should not replace the other. And as the basic investment principles recommend, we shouldn't put all our eggs in one basket.

So the answer to the initial question is: it depends.

It depends on whether you already have real estate in your portfolio and the percentage it represents, it depends on the type of assets and opportunities available and it depends on your investment objectives. And it depends on the expectations for the markets and the economy in the future. And this analysis is more important than ever.

This phrase is a well-worn phrase, but after such positive years it acquires a whole new importance that all investors should always bear in mind:

The returns and other numbers presented in this article are historical and as such are not a reliable indicator of future results and should not be the only factor to consider when selecting an investment product or strategy.

Vítor is a CFA® charterholder, entrepreneur, music lover and with a dream of building a true investment and financial planning ecosystem at the service of families and organizations.

+351 939873441 (Vítor Mário Ribeiro, CFA)

+351 938438594 (Luís Silva)

Future Proof is an Appointed Representative of Banco Invest, S.A.. It is registered at CMVM.