Computational finance at the service of Wealth Management

In a world of dizzying technological advances, the Wealth Management industry is also undergoing rapid change, with a direct impact on the way we save and invest.

The management model shifted from focusing solely on offering at the product level to offering at the level of service, experience and knowledge, from the more quantitative to the qualitative aspects related to our behavior and psychological profile.

Digitization and data science have reinforced this status as so-called routine and repetitive tasks are being allocated to technology. Thus, technology and algorithms appear as support and not replacement elements for the financial advisor.

Alongside this transformation, also emerged the more complex and often exotic side of financial engineering or, as it is also known, Computational Finance.

This approach has always been available to Wealth Management, having evolved a lot with the work of various researchers and analysts over the last century. Based on a very technical and theoretical perspective, several professional investors have developed tools to obtain a more rational, more optimized and even more personalized investment portfolio for the investment objectives.

But if these attributes were far from being massified and democratized for the common, non-professional investor, financial engineering reached them in the form of complex financial products, difficult to understand, not very transparent and with high risk.

It can be said that the financial crisis of 2007-2009, and even the public debt crisis in the European Union, was, to a large extent, provoked and exacerbated by this sophisticated and exotic environment, often unregulated and unknown to common investors, so-called of retail.

But financial engineering, or computational finance, should not be seen as the problem. In fact, the good use of these tools makes it possible to improve the portfolio's performance, in terms of risk and return, producing portfolios and results that are more adequate and consistent with the individual interests of each investor. And it should not only be available to so-called institutional investors or investment banks, as they end up distorting and making the financial market more asymmetric.

Therefore, we believe that the solution lies in knowledge, education and the use of these tools for those who want to build a long-term financial plan, based on their goals and preferences, in a transversal way:

- Take advantage of big data and machine learning techniques to manage and select financial data, asset classes or financial instruments;

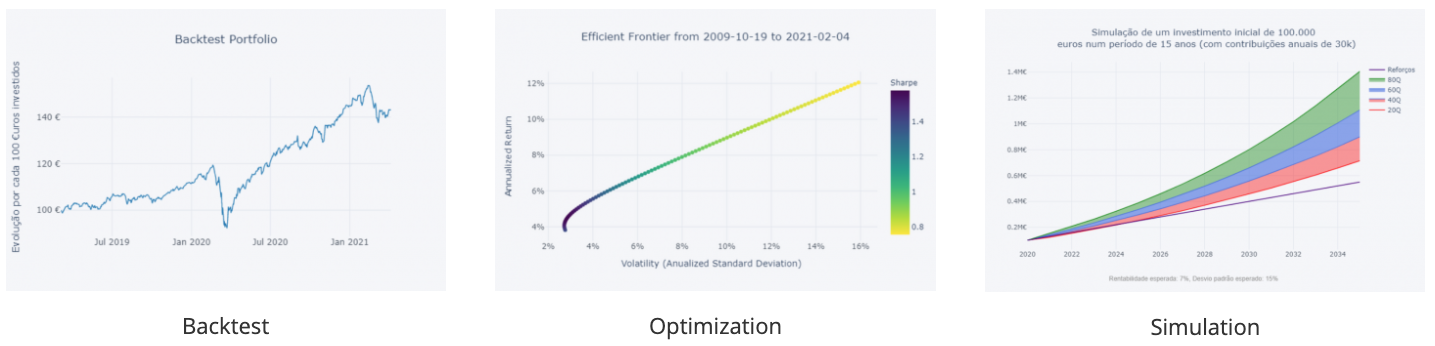

- Use Monte Carlo Simulation to estimate the behavior of our portfolio in the future;

- Optimize the investment portfolio based on statistical concepts such as mean and variance;

- Build or rebalance a risky asset portfolio across the efficient frontier proposed by Harry Markowitz where the various possible asset allocations are evidenced;

- Build the correlation matrix between the various assets that make up or may come to make up the portfolio in order to obtain a better diversification of it and optimize it for the risk-return binomial;

- Manage risk according to the metric we want, be it the maximum decline in the portfolio, the potential loss or the variability of asset prices;

- Evaluate portfolio performance using techniques such as backtesting and comparison with benchmarks and other investable assets with similar characteristics.

These and other techniques we consider essential to be used in any investment portfolio or financial plan. It is in this practical perspective that we see the use and availability of these computational tools for all investors. That's why we believe in solutions such as Future Analyzer but also from a perspective of the do-it-yourself (DIY) investor, as in the case of PortfolYou.

Computational Finance allows us to include in a quantitative process knowledge of computer science, mathematics, economics, finance, engineering and related areas related to technology and data science. In a world of algorithms and machine learning, as Pedro Domingos mentions in the book “The Master Algorithm”, we have to take advantage of this immense knowledge to improve our lives. In this case, to improve our investment portfolio and achieve our investment, return and risk objectives in full alignment with our preferences and constraints.

Vítor is a CFA® charterholder, entrepreneur, music lover and with a dream of building a true investment and financial planning ecosystem at the service of families and organizations.

+351 939873441 (Vítor Mário Ribeiro, CFA)

+351 938438594 (Luís Silva)

Future Proof is an Appointed Representative of Banco Invest, S.A.. It is registered at CMVM.